Historical Daily Intraday & Tick Futures Data

Futures Forex Cash Commodities Fixed Income

Calendar Spreads

ETF’s

We provide 123 years of historical daily, intraday and tick futures data from 1899. With Portara’s tailored service you can order CQG DataFactory continuous futures data or individual contract data at Portara discounted prices. Our historical futures data can be purchased as a one-off data dump or inclusive of daily updates and our award winning software.

Specifically designed for CTAs, hedge funds, portfolio managers, quants and traders, Portara will guide you through the many nuances and issues that surround the purchase of quality data sets.

Historical Futures Data – Asset Classes & Sectors

Our historical futures tick data, daily and 1 minute data packages include global commodities, forex, stock indices, cash contracts, fixed income sovereign debt, calendar spreads and ETFs. Our CQG Data Factory sectors include historical futures data for foreign exchange, energies, financials, meats, metals, currency, softs, exotics and indices. If you are a quant, fund manager CTA or serious trader then this is the place to be.

Historical Futures Data – Commodities

We provide CQG Data Factory futures and forex data including Gold, emini S&P, emini Nasdaq, emini Dow, micro S&P, micro Nasdaq, Crude Oil, Natural Gas, Lean Hogs, Live Cattle, Cotton, Coffee, Copper, US Treasury Bonds and thousands more…

Continuous Futures Data Deep Dive

Learn why Portara is the leading industry provider of Continuous futures Data. Learn what continuous futures data is and why it is important.

We will help you and your team make the right choices

Historical Daily Futures Data

We supply up to 123 years of daily data for backtesting and trading. For traders needing backadjusted daily data you can choose from zero, back, forward and ratio adjusted roll methods for your continuous daily data purchases.

Historical Intraday Futures Data

We supply over 45 years of historical intraday futures data on thousands of commodities and forex pairs. Purchase historical intraday futures data continuous or individual contract-based from 1987.

Historical 1 Minute and Daily Data for thousands of Futures & Forex instruments.

Daily Data Solution

All About Daily Data

Learn about our proprietary FIVE PRICE POINT DAILY DATABASE and how it will help you create diverse daily data bars based on Settle or reported Last Price.

Discover why standard daily data may not be the optimal way to conduct your testing and trading.

Find out the secret of opening prices in relation to 24 hour trading.

Intraday Data Solution

All About Intraday Data

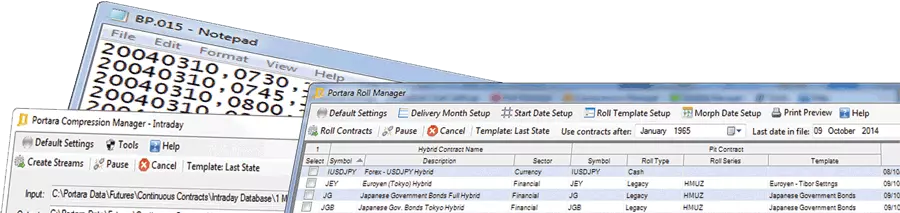

Learn how Portara can customise your data formats and roll your data into continuous files.

Customise your timestamps to exchange or local time, wherever you are in the world.

Use our proprietary ‘Dynamic Sessions’ filters that follow overseas exchanges respecting Local DST.

90 Second Demo of All Main Features

Watch How Portara Creates Back Adjusted Historical Intraday Futures Data & Daily Data

Do you need to alter the volatility of your historical intraday futures data sets, randomise the opens and closes for statistical robustness testing?

Do you wish to have global markets timestamped by exchange time, or by your local time?

Do you need a way to correctly timestamp your historical intraday data?

Portara Has Two Types Of Purchase Options

Option 1: A Direct Purchase of CQG Data Factory ASCII TXT CSV Data

Portara has over 10,000 Futures, Forex, ETF’, Stock Indexes, Cash Contracts, Fixed Income and Continuous futures and forex data.

We also supply zero and back adjusted intraday data including data from all futures sectors such as Energy, Grains, Meats, Metals, Financials, Indexes, Softs and Currency foreign exchange markets.

We include all roll, compression timestamp choices and formatting work in our quotes.

Choose your symbols from our extensive databases. Choose from : Daily, Intraday, Tick – Trades Only and Tick – Level 1.

Option 2: The Same Data as Option 1 PLUS The PORTARA CHARTS Powerhouse

Roll data into continuous form. Data can be rolled by zero, forward, ratio or back adjust, using any compression, 1 min, 2, 3, 5, 10, 15, 30, hourly, daily.

Set dynamic open and closing session times across 45+ years of historical intraday all-sessions data. Cut away unwanted illiquid morning and evening sessions. Create overnight daily bars.

Randomize opens and closes — strategy and robustness testing tools — included as standard.

Automate updates, rolls and compressions, including command line and batch file processes.

Portara | Awards

HFM Awards 2015

WINNER!

Portara wins an award at the HFM Awards November 2015. Also Portara was voted with the highest commendation for ‘Best Data Provider’.

HFM Awards 2016

HIGHLY COMMENDED!

Portara wins a highly commended award at the European HFM Awards November 2016. Portara was ‘highly commended in the ‘Best Data Provider’ class.

HFM Awards 2018

WINNER!

Portara wins the BEST MARKET DATA PROVIDER AWARD at the HFM European Technology Awards 2018. The shortlisted applicants for this award were Thompson Reuters | Quanthouse | Options and Portara!

HFM Awards 2019

WINNER!

Now, Portara wins the BEST ALTERNATIVE MARKET DATA PROVIDER AWARD at the HFM European Technology Awards 2019.

Portara | The Big Data Powerhouse

Portara | A Summary – Historical Intraday Futures Data

Portara Extraction Software

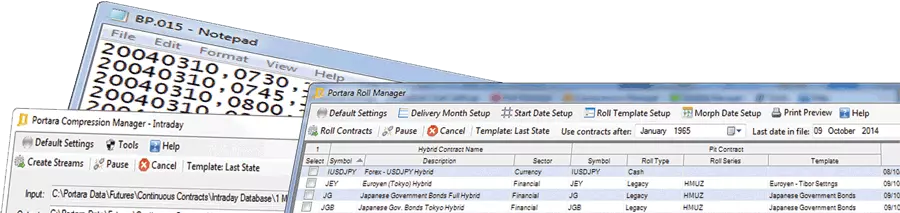

Portara® is CQG Data Factory’s extraction software. It allows you to create actual data (tenors) and continuous back-adjusted streams from CQG historical intraday, daily futures, cash, ETF and forex data.

Local Database

Intraday and daily databases are local to your machine extracting ASCII TXT CSV to any time frame and format guaranteed for all backtesting platforms.

Integrated Solution for Futures & FOREX Traders

Portara is a completely integrated historical intraday data solution for hedge fund and portfolio managers, quants and traders.

Auto Updates from CQG

Portara includes session time extraction and cross-pit/cross-electronic coupling. It includes an intraday/daily updating service immediately after the US market closes for timely decision-making prior to next open.

Create Regular Trading Hour RTH Data

It can create Regular Trading Hour (RTH) daily bars and limitless combinations of historical intraday data modelling.

NO Prerequisites or Exchange Fees

A subscription to CQG Integrated Client or CQG API is not necessary. Data updates are exchange fee exempt.

Portara | The Big Data Powerhouse

Where Has the Open Gone? (Is legacy daily data dead?)

Has 24h trading destroyed the significance of the open as a precursor to initiate a trade? Read the editorial article written by Arthur Maddock for CTA Intelligence magazine.

Arthur talks about ‘Volatility Off The Open’ style systems. This is a major paradigm shift that should make you pause for thought. The significance of this phenomenon may have profound effects upon your backtested results or worse. If you are a CTA or Quant testing for trade verification strategies in this area then this article is worth reading. There is a video about the article’s conclusions in the video section.

Portara | Simple Mechanics – Regular Trading Hours Data With CQG Data Factory Database

Portara wraps itself around CQG Data Factory Data allowing you to create continuous and actual historical intraday data in any format you need for backtesting your systems.

Portara is platform-neutral and can be used to create ASCII TXT and CSV data exactly the way you need them.

You can create historical intraday data down to 1 minute resolution by rolling the actual CQG data contracts and then compressing them to your chosen format.

Portara gives you full flexibility and control over your roll settings. You can even read roll dates into Portara from a text file and roll based upon these external dates.

Regular Trading Hours data under normal circumstances is very difficult to create. Portara allows you to customise your session times so that you are in full control of your historical RTH data.

You can chop away the morning, evening and night sessions and create custom daily data. The daily OHLC bars are now based upon the intraday database.

You can change the open and close session times to whatever you want. You can also create overnight daily bars, or intraday. Have a daily open in the prior day session and a close in today’s, with highs and lows in-between. Test for trading edges where no one else does, the possibilities are compelling.

So, how cool is that?

Portara provides CQG Data Factory historical intraday futures data.

We include the award winning Portara — our data extraction powerhouse — our roll and compression management front-end.

Keep your data up-to-date

with our CQG data update service

Tailored Pricing

Thinking of onboarding and need a Quote?

Speak to Portara or CQG about your needs & requirements.

Tailored portfolios can be setup to suit any trading operation small or large.

Singular or multiple licences and discounting options are available.

A Subscription to Portara includes the CQG Data Factory Databases

Asset classes comprise Futures, Cash, Fixed Income, ETF’s and Forex back to inception.