C# Portara Api For The Smart Quant 2014 Framework

Profitable Trading Strategies

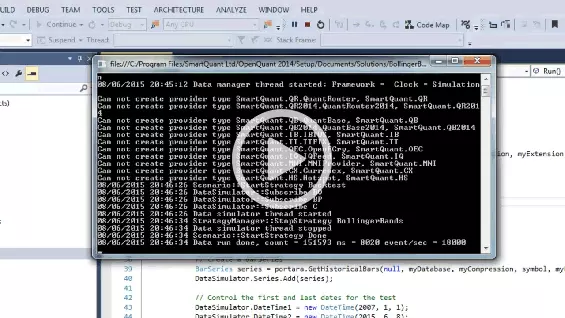

Let’s see how we can use Smart Quant and Portara to explore and find profitable trading strategies with continuous futures using a simple backtesting strategy

Zoom in on the Roll Process with Smart Quant and Portara

In the video you will see that when you have found a workable trading signal you may zoom in on the roll process and optimise and automate the transactions there.

Develop Trade & Maintain

With these two tasks taken care of, you may develop, trade and maintain futures and FX based strategies in a seamless manner.

You may create, test and develop ‘Sell Side’ strategies by calling all the necessary data through the API seamlessly. You may create portfolios of data to any compression and using customisable sessions and multi sessions to remove the illiquid unwanted part of 24 hr data. Intraday data is back to inception 1985. Simply create and use continuous data within the Open Quant framework with one simple API call. Portara works with all Open Quant frameworks and is integrated with PortaraAPI in the newer 2014 framework.

The Smartquant Portara Partnership

About The Company

With these two tasks taken care of, you may develop, trade and maintain futures and FX based strategies in SmartQuant is a financial software company developing End-to-End Algo Trading Infrastructure for quantitative hedge funds and institutional trading groups. The mission statement of SmartQuant is to provide quantitative traders and investors with an industrial strength strategy development, debugging, back testing, optimization and automation platform that helps to win the race and grow to the next level, while respecting their budget constraints. Our products and the underlying frameworks have been widely used, with hundreds of users over 10+ years, ranging from individual traders to some of the largest market makers and institutional investors.

Our partnership with Portara

SmartQuant has partnered with Portara to provide to its clients that employ algorithmic trading strategies a streamlined access to a historical daily and intraday data for futures and FX markets with the flexibility managed data maintenance using Portara databases and direct API integration with SmartQuant strategies. Using SmartQuant products, these clients can develop and backtest their own strategies across any of the markets covered by Portara.

Product Lineup and Main Features

OpenQuant uses a complex event processing (CEP) architecture to represent real-life trading events accurately. Our next-generation framework has pushed the performance and design flexibility to new heights. There are four components in the product family:

OpenQuant

OpenQuant is a modern IDE integrated development environment for creating and testing computerized trading strategies. This is where the action is for human strategists as they create, develop, test and optimize new strategy candidates. It solves all the usual problems of importing market data, inspecting the data in table or chart form with built-in technical indicators, developing code, backtesting to evaluate performance, and visualizing trading behaviour with bar charts, equity curves, performance statistics, and portfolio trading logs.

OpenQuant is suitable for any style of investing, ranging from strategies driven by daily signals to high frequency trading utilizing the system’s ability to process up to one million events per second. The IDE uses C# on the Microsoft Windows .NET platform, and is fully user-extensible.

QuantBase

QuantBase is a stand-alone infrastructure application for managing large amounts of market data. It contains a high-speed internal database (up to 1M IOPS) for fast access to time series data. It solves the problems of collecting, storing, managing, and exporting huge amounts of market price and volume data at very high flow rates.

QuantRouter

QuantRouter is a stand-alone infrastructure application for routing, combining, and splitting data feeds from multiple data sources and routing order feeds to multiple brokers. Its speed is sufficient to handle real time streaming market data for thousands of securities with low latency and without bottlenecks even during the peaks of market activity. It solves the problem of centralizing the data and order feeds to and from production QuantTrader instances, as well as QuantBase at the same time.

QuantController

QuantController is a server infrastructure application designed for monitoring and maintenance of a distributed trading environment composed of multiple SmartQuant products residing both locally and remotely.

For more information, please see the detailed documentation on Smartquant’s website: www.smartquant.com